SmartCost Quarterly

By Thad Berkes

April 3, 2023

|

This quarter’s DC Estimating Report identifies key pieces of information to note about the A/E/C industry, including trade labor shortages, lead times and supply chain trends, and construction material trends. Read on to know more about the current state of the industry. Image by Ümit Yıldırım on Unsplash |

|

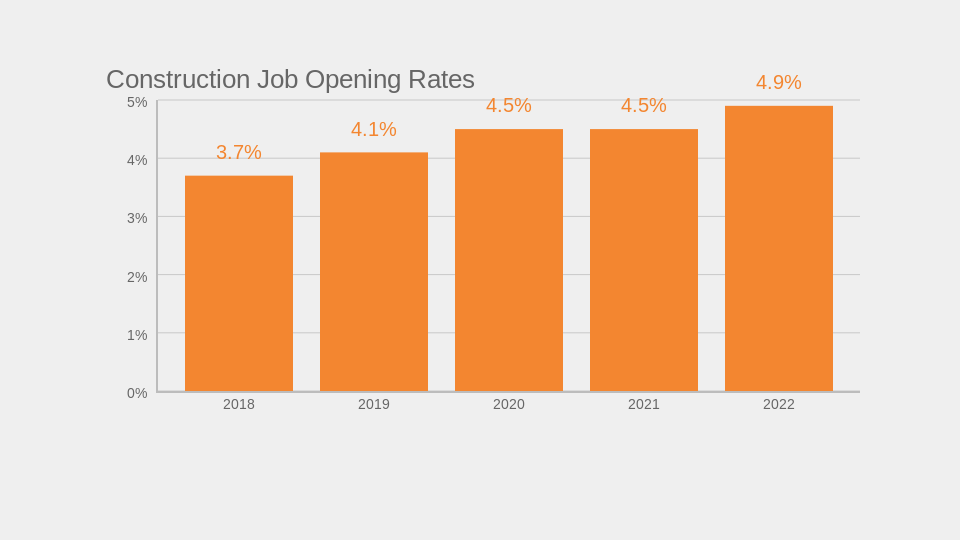

Trade labor shortages: It is clear that the labor shortage in the construction trade is a serious challenge and one that needs to be addressed in order to ensure the future stability of the industry. It is essential that all stakeholders work together to identify and implement effective solutions, such as new training and job creation programs, to ensure a strong and reliable workforce. By doing so, the industry can continue to thrive despite the current labor shortage. As the current report stands, here are a few key pieces of information to note:

|

|

|

Lead Time and Supply Chain Trends: It is important for companies to stay up to date with changing trends and emerging technologies in order to ensure a successful project. By staying ahead of the curve, companies can better meet customer demands, reduce costs, and ensure efficient solutions with supply chain challenges. This quarter’s cost estimating report notes in relation to lead times and supply chain trends:

|

|

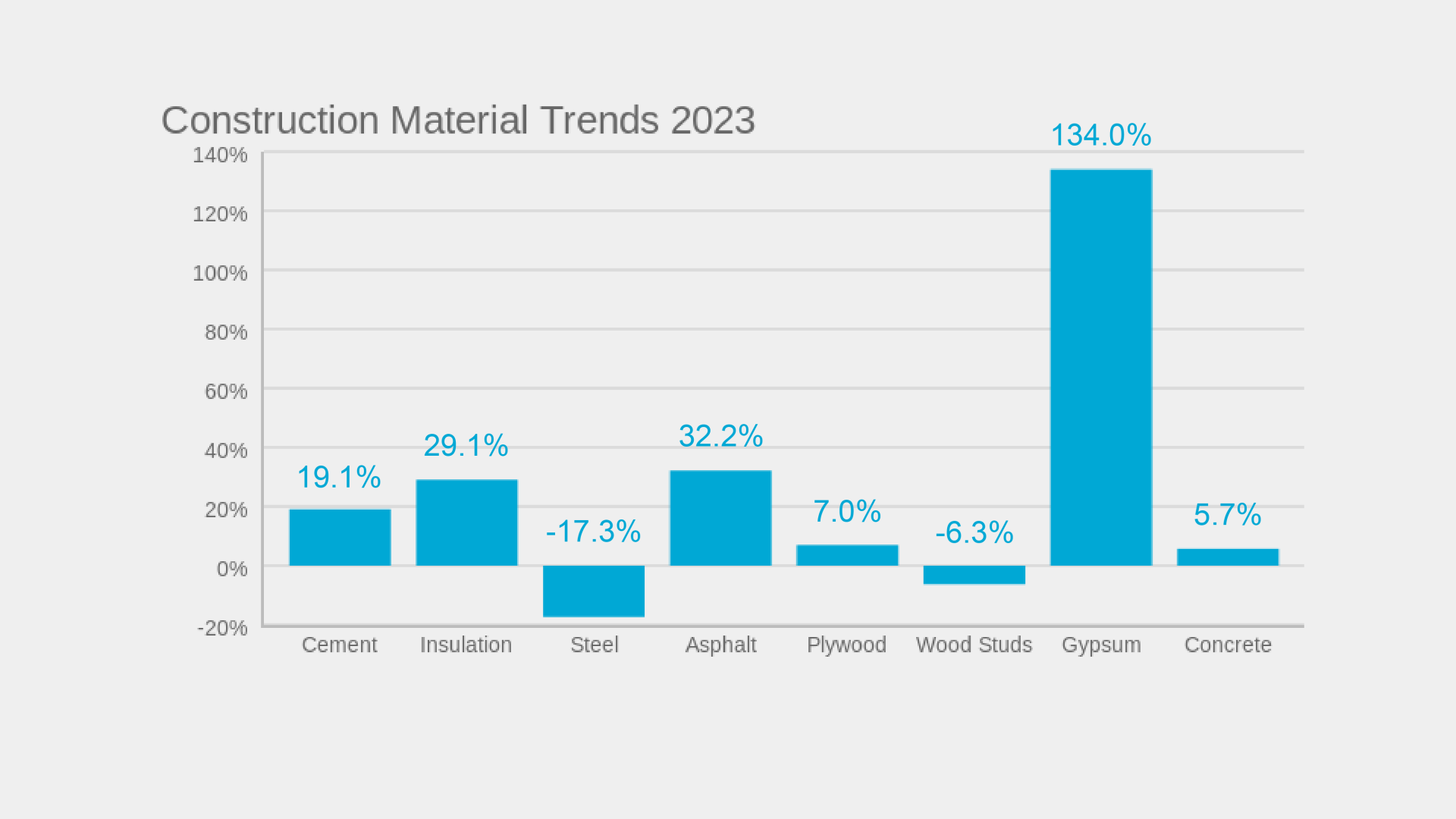

Construction Material Trends: Knowing the trends in construction material costs is essential for construction businesses to plan their projects and budgets effectively. The cost of construction materials has been greatly impacted in 2022 due to the Covid-19 pandemic and resulting economic downturn. Important construction material trends to note this quarter:

|

|