Lead Time Considerations

Another critical aspect of construction planning involves lead times for essential items, particularly in renovation projects. Here are some current estimates:

- Doors and frames need around 9 weeks.

- HVAC equipment (roof-top units) requires approximately 18 weeks.

- Exhaust fans have a lead time of 7 weeks.

- Cabinet unit heaters stretch out to about 8 weeks.

- Electrical panels can be 6-12 weeks.

- Electrical automatic transfers switches require around 12 months.

- Utility transformers can take 12 months.

It’s crucial to note that lead times begin after contracts are awarded and shop drawing approvals are obtained. For smaller renovation projects, securing these approvals ahead of the construction start date can help ensure materials arrive on time, meeting completion schedules.

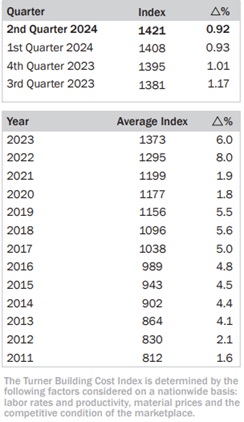

Since January 2021, we have seen an exponential increase in construction costs due to the increasing cost of materials and construction demand.

Since January 2021, we have seen an exponential increase in construction costs due to the increasing cost of materials and construction demand.