Revolutionizing Retail Banking: Unveiling the Five Secrets to Branch Design

By Adam James, AIA

March 21, 2024Post Tagged in

|

In the dynamic landscape of retail banking, the ability to adapt to ever-changing client needs and stay ahead of industry trends is paramount. Even when considering a dramatic increase in online and mobile banking over the past two decades – and most noticeably the shift in banking habits brought about by the COVID pandemic – bank and credit union branches are still utilized and necessary. Instead, their purpose continues to evolve. It is critical that bank and credit unions continue to focus on improving the customer experience and enhancing employee engagement. There are five secrets to branch design that will ensure financial institutions meet the current needs of customers and employees as well as remain relevant in the future. |

Member ExperienceConsider the fact that when customers enter the branch, they’ve intentionally chosen to go inside and interact with a person rather than conduct the transaction electronically. It’s critical to create an inviting, welcoming space that takes into account natural lighting, the use of colors, accessible entryways, and inclusive designs. The last thing you want is for customers to feel overwhelmed, lost, or intimidated when they walk into your building. Keep a customer’s journey in mind. Will they immediately know where to go to receive help? Is the space easy to navigate without physical obstacles in their way? A more traditional model might include a waiting area, small café or coffee station, and welcome desk along with teller lines and offices. A transitional model would incorporate those same elements but could feature flex offices that provide a private setting when needed. A universal model might put customer support areas in a prominent, easily recognizable and accessible location so that customers are immediately greeted and then directed to where they need to go based on the specific services they need. They could also include larger conference rooms or flexible workspaces. In some cases, those universal designs require a smaller footprint because the areas are more adaptable to meet the needs of both customers and employees. |

|

|

TechnologyThe use of technology is essential but should always be used when enhancing the customer or member experience. When thinking of how to design the space, leverage technology when it makes sense, but don’t incorporate it as a substitute for human interaction. Interactive Teller Machines (ITMs) have become more popular inside branches, but we’ve found that they’re not always the best experience for the customer. Again, if they’ve made the choice to go into the building, they’re perhaps looking for personal, one-to-one contact with someone who can help with a simple or complex transaction, opening or closing an account, or offering advice. If you have tellers available, it’s probably not necessary to also have an ITM. One element we have found to be effective is digital messaging boards. They can be easily updated and can be consistent across your branch network to include important information as well as marketing messaging. |

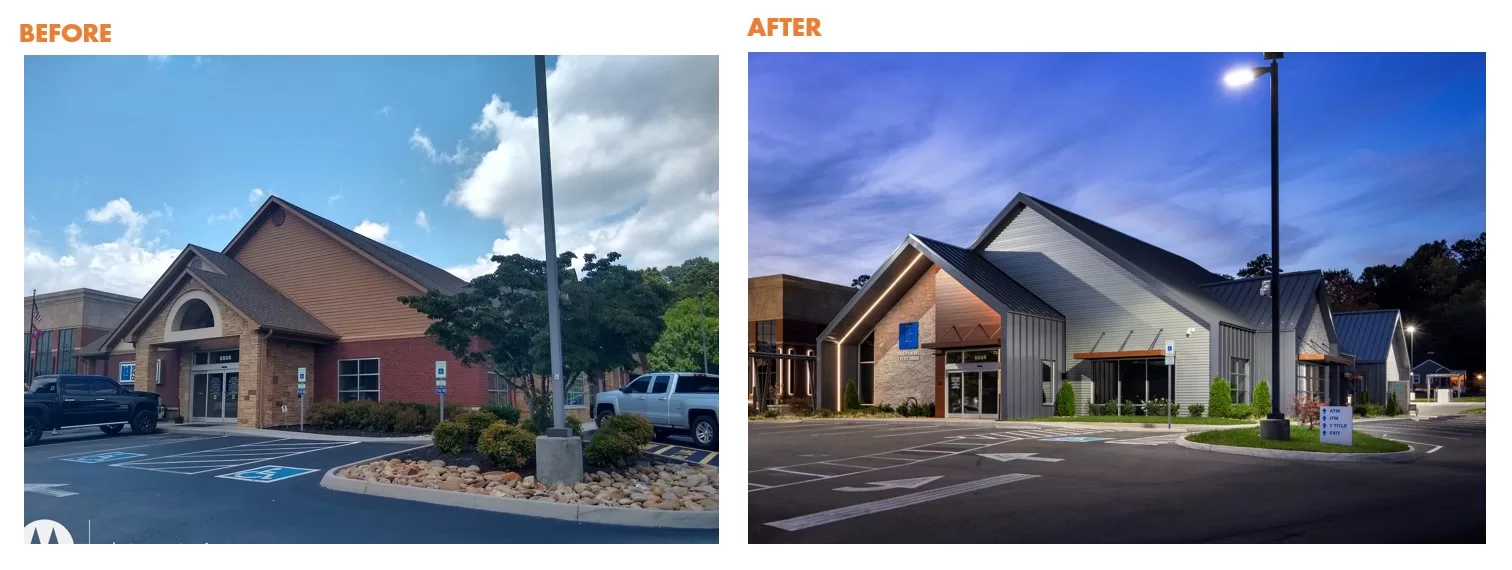

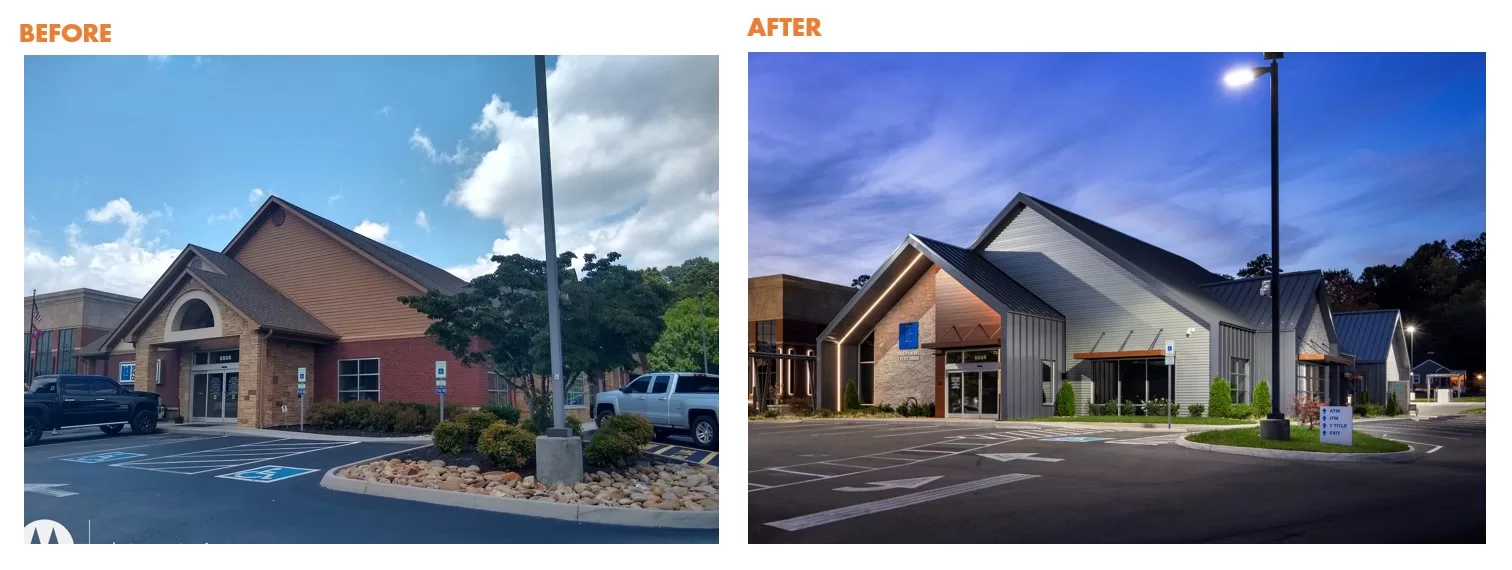

Brand Activation & ReinforcementYour branches should be a reflection of your unique brand. By strategically using logos, signage, colors, furniture, and specialty lighting, you can create an immersive, cohesive brand experience both inside and outside the building. Customers and members aren’t going to get that experience when using your online and mobile services, so a physical branch location is the perfect opportunity to showcase your brand. Don’t be afraid to leverage those assets as a way to introduce and reinforce your mission. |

|

|

Future in MindHow can you prepare to ensure the success of your branch 10, 15, or 20 years down the road? The easiest way is through technology, which we’ve already touched on. ITMs are one way to do this. Maybe you want to consider making drive-through lanes wider to accommodate more ITMs. It doesn’t mean you have to do it today, but it’s smart to be thinking ahead to the possibility. Also be thinking about flexibility in your design. If you currently don’t have teller pods but they are part of your strategic plan down the road, you can be preparing for them now. If you’re using a space for an office now, you can design it so that it could someday be used as a meeting space down the road if your needs change. It’s also important to keep your employees in mind when it comes to flexibility because you want to create spaces for them that increase their engagement and help them look forward to coming to work each day. Furniture is an easy and relatively inexpensive way to plan for the future. You might need a space now that has four larger chairs in it but down the road it might make more sense to put a high-top table to work counter in it. |

Understand Costs

It’s important to have a comprehensive, clear understanding of what your costs are. When we refer to construction costs, that includes everything related to building a structure from the ground up, everything from the foundation to walls. That is usually the majority of your cost of a branch, but it’s not the only thing. Soft costs include things like architecture fees, lawyer fees, permitting, or other fees. They can really add up, so it’s crucial to know what some of those costs will be up front. You also want to have a contingency fund for unexpected things that come up or for the inevitable challenges or issues that arise when building a branch.

Of course, there are many other things to consider when looking at construction and/or design of a bank or credit union branch, but these five areas are good places to start. By prioritizing clients, embracing technology, activating brand identity, designing for flexibility, and navigating construction costs judiciously, financial institutions can position themselves for success in an ever-changing landscape.