Construction Costs Update: A Closer Look at Spending, Labor, and Tariffs

By Thad Berkes

October 29, 2025Post Tagged in

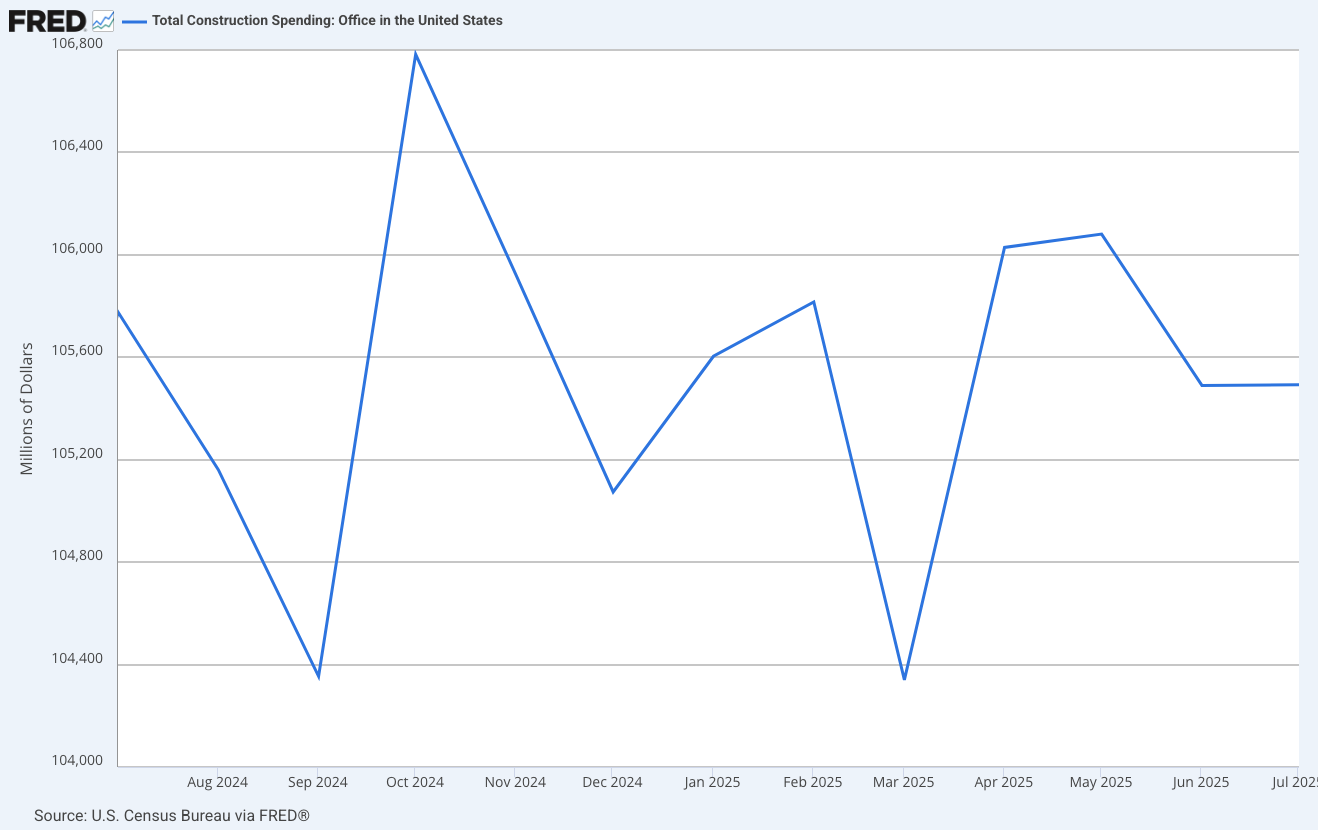

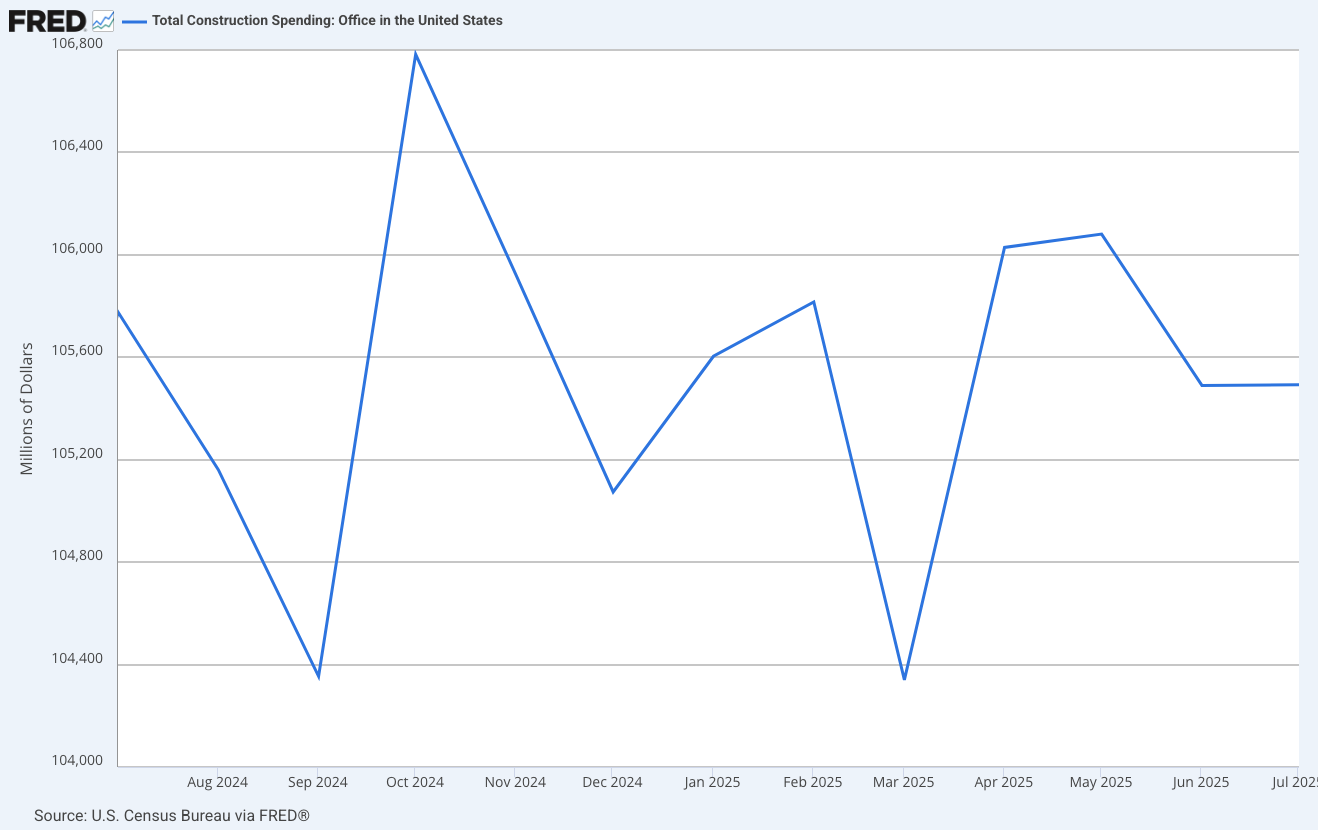

Wow, what a roller coaster we’ve had over the past several months with tariff uncertainties. One thing we can count on, however, is the data that helps us understand what’s really happening in the market.Construction Spending TrendsAccording to the Federal Reserve Economic Data (FRED) on Total Construction Spending in the United States, costs have started to level off, appearing to plateau for the time being. After years of volatility, this pause in fluctuation provides some welcome breathing room for project planning and budgeting. |

|

|

Building Cost IndexThe Turner Building Cost Index is showing a 4.19% year-over-year increase from 2024—slightly higher than last year’s 3.9%, but still more moderate compared to the dramatic shifts we saw earlier in the decade. For reference, between 2021 and 2022, the index jumped from 1.9% to 8%, reflecting the sharp inflation and supply chain disruptions of that period. Historically, cost growth has averaged between 4% and 5% per year, with a dip to around 2% during the height of COVID and a surge back up to 8% in 2022. Seeing numbers stabilize in the 4% range is a promising sign for both owners and contractors—indicating that the market is normalizing after several unpredictable years. Stability is a welcome development across all aspects of construction. |