Construction Costs Update: Navigating Tariffs, Workforce Needs, and the OBBBA Impact

By Thad Berkes

July 30, 2025Post Tagged in

|

As we move into the second half of 2025, construction industry leaders are keeping a close eye on the forces influencing cost, demand, and availability. While inflationary pressures have eased slightly, uncertainty around tariffs, labor shortages, and legislative impacts continues to affect project planning and execution. Here’s what you need to know. |

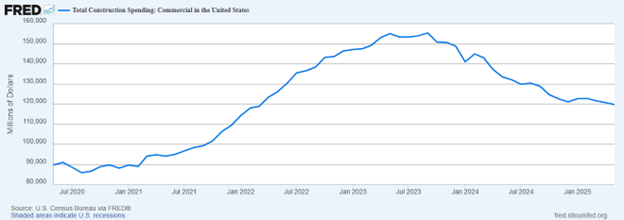

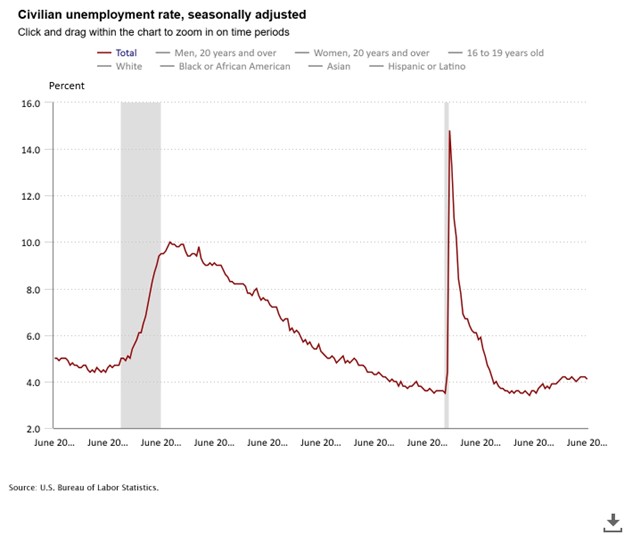

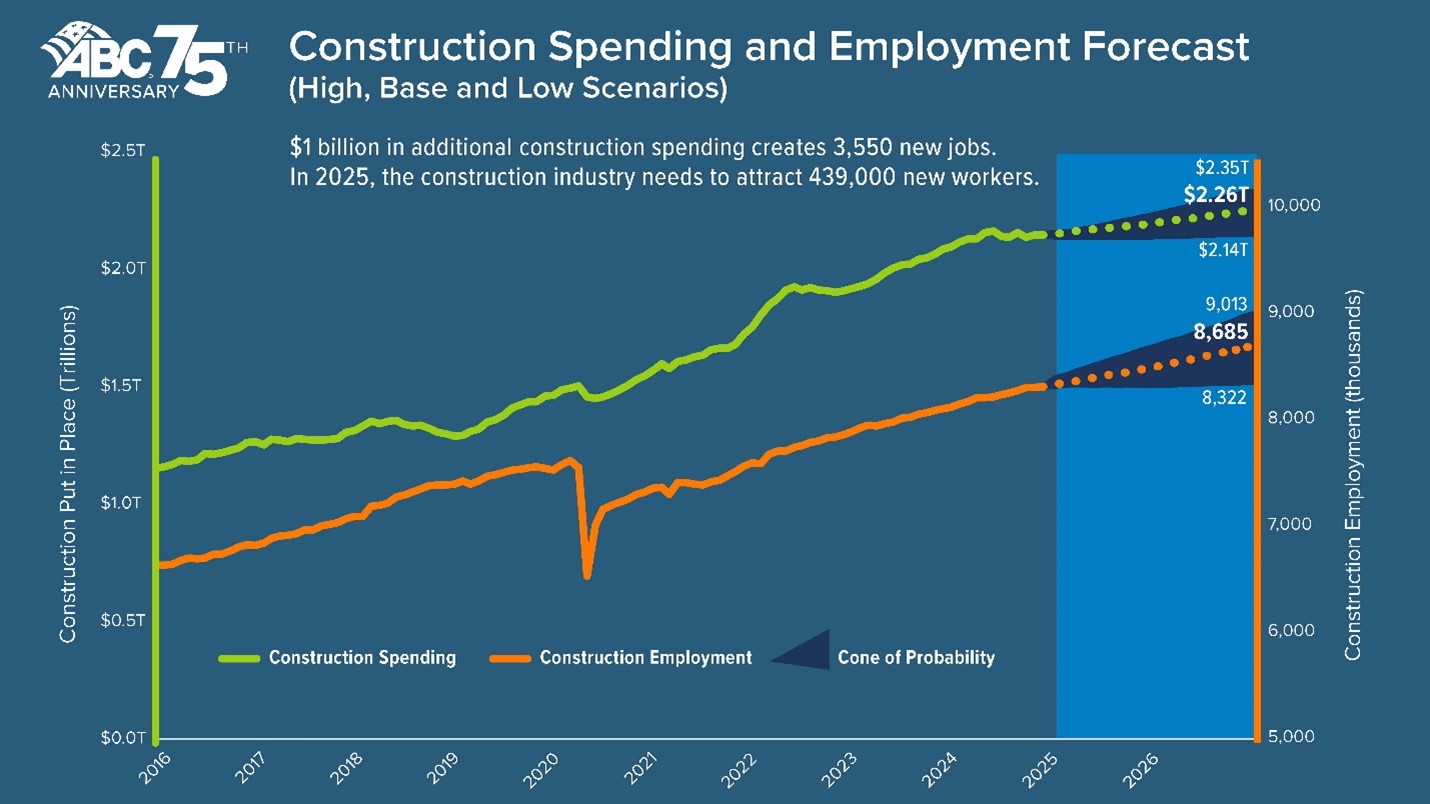

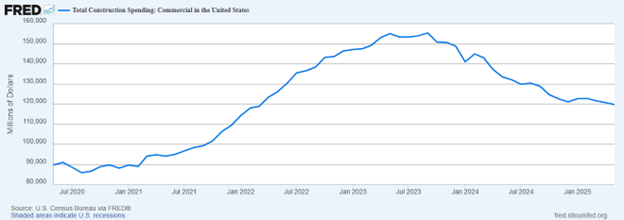

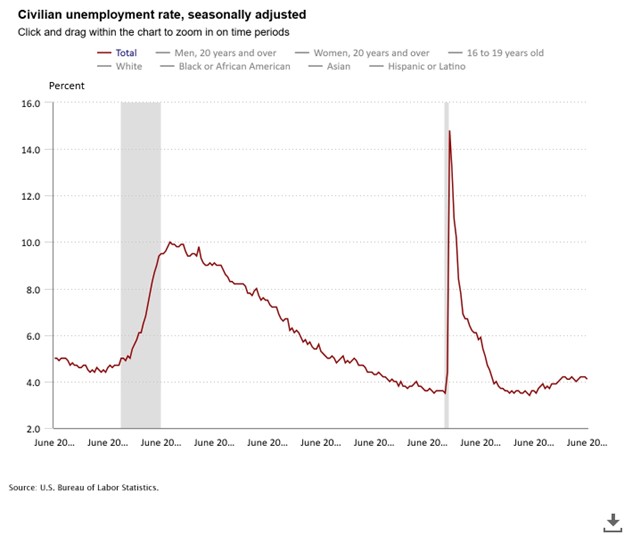

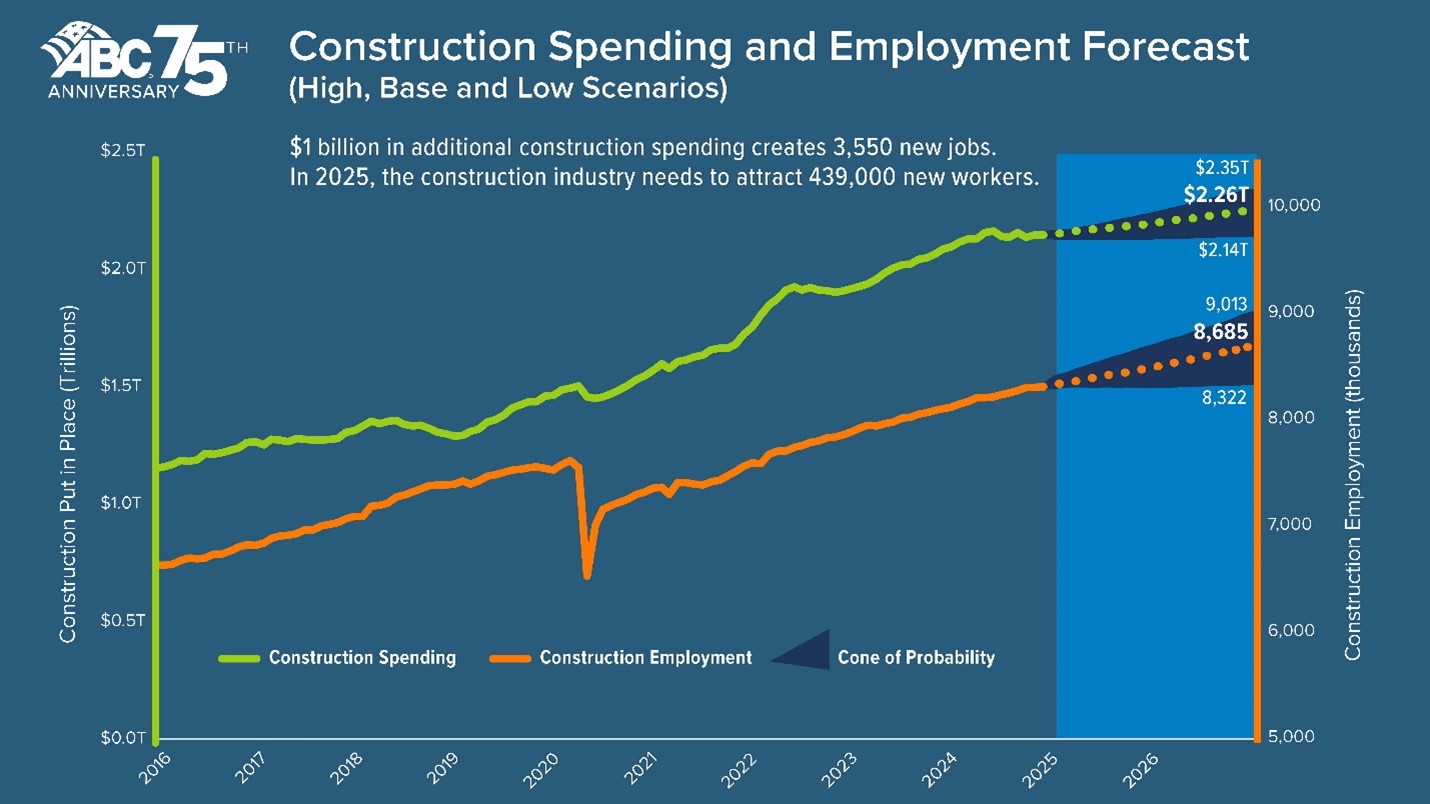

TariffsTariff uncertainties remain a major concern when it comes to construction material costs and availability. In response, suppliers began stockpiling materials to avoid paying higher tariffs and passing those increases on to consumers. This behavior, while temporarily cushioning price volatility, has contributed to a slowdown in the commercial construction rate. Construction SpendingAccording to FRED data, Total Construction Spending in the United States has been in steady decline since its peak in September 2023. Cost uncertainty, labor shortages, and shifting demand are all contributing factors. As a result, the commercial construction industry is experiencing a marked deceleration. One Big Beautiful Bill ActSigned into law on July 4, 2025, the One Big Beautiful Bill Act (OBBBA) permanently reinstated 100% bonus depreciation for qualified property placed in service after January 19, 2025. This allows companies to claim 100% bonus depreciation on eligible assets in the first year rather than over time, creating opportunities to improve cash flow and make new investments. Along with real estate tax depreciation deductions, Sec. 179 deductions are also allowed for roofs, HVAC equipment, fire protection, and alarm systems. Consider conducting a facility assessment now to evaluate the life expectancy and depreciation value of your roof, mechanical equipment and other building assets. LaborThe unemployment rate has held steady at 4.1% over the past year. However, Associated Builders and Contractors reports that the construction workforce will need to attract 439,000 net new workers nationwide to meet demand in 2025. On a positive note, the average hourly earnings for construction workers have increased by 4.4%, which outpaced earnings growth across all industries. This reflects both strong demand and the sector’s efforts to attract new talent with higher earnings. Interest RatesInterest rates have remained steady, with the Federal Reserve maintaining an average rate of 4.3% since December 2024. President Trump has pushed for lower rates, but Federal Reserve Chair Jerome Powell has resisted so far. As of July 30th, the US central bank has confirmed they will keep interest rates unchanged where they have stood since December. While most economists expected no immediate change for July, a rate cut in September is possible. |

|

|

Looking AheadThe second half of 2025 will likely continue to present a mixed bag of opportunities and challenges. Understanding the implications of new legislation, market shifts, and workforce dynamics is critical for making smart decisions. |