Banking Branch Models: The Impact Design has on Your Bottom Line and Customer Experience

By Adam James, AIA, NCARB

July 26, 2021Post Tagged in

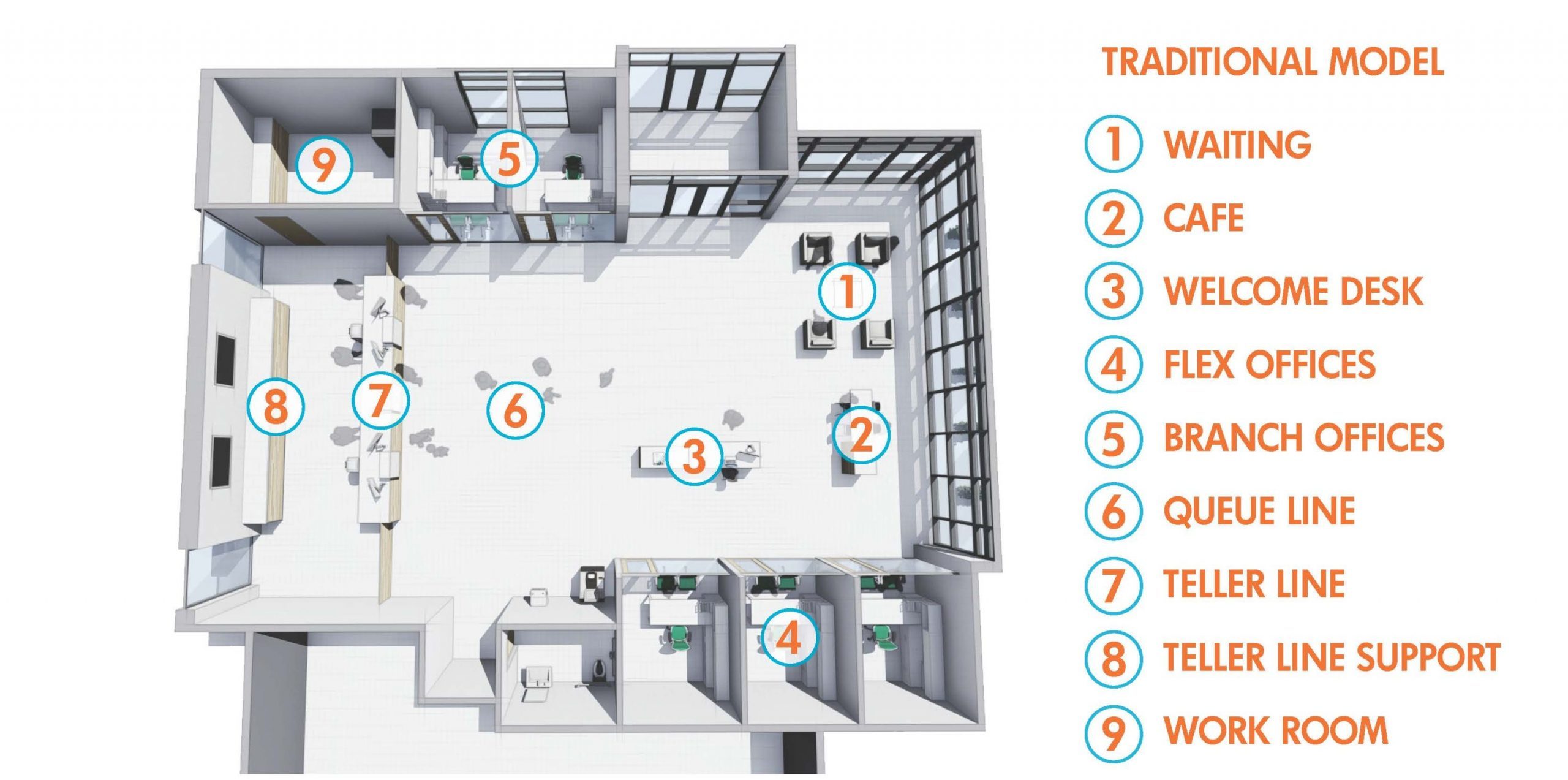

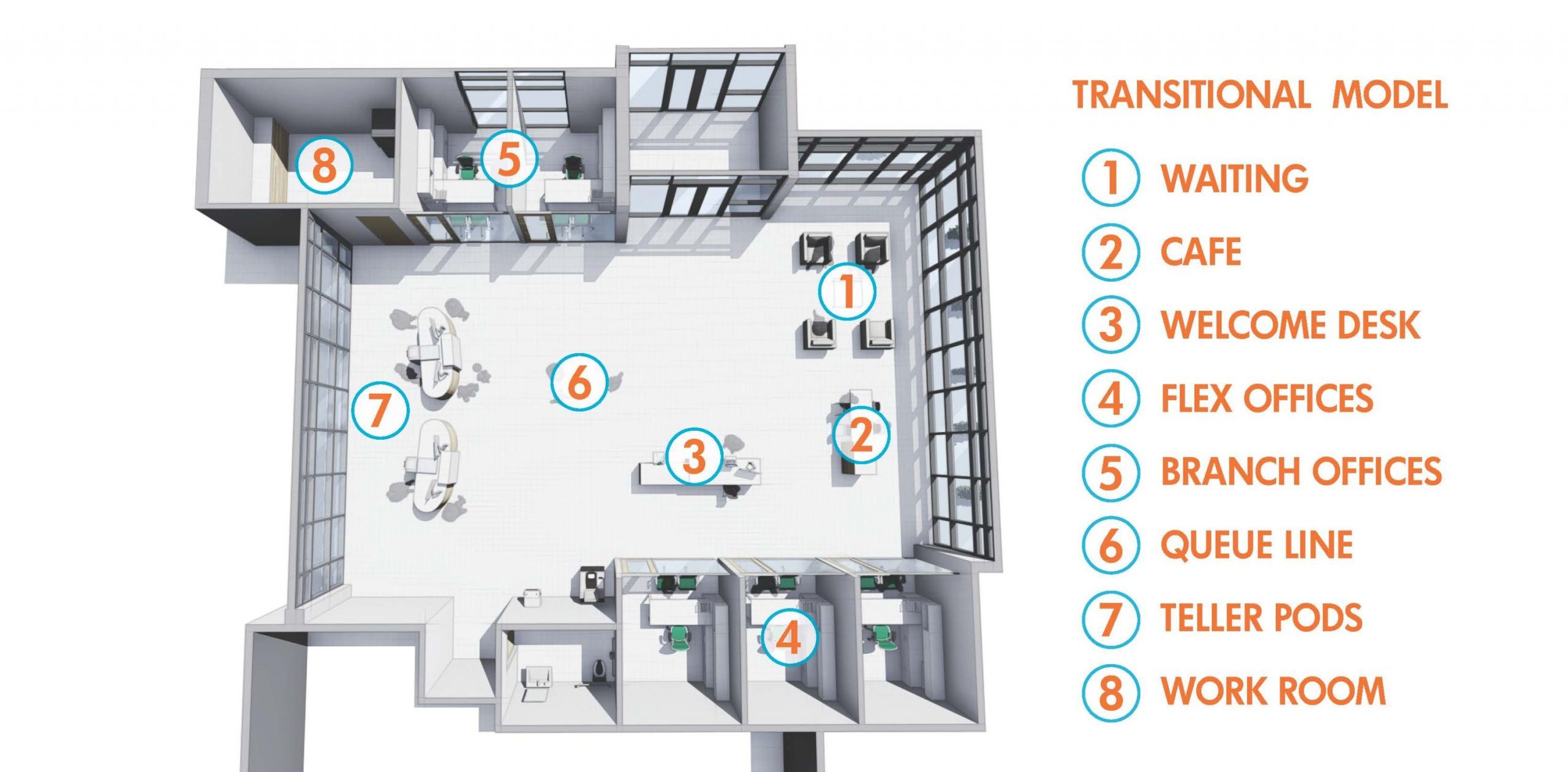

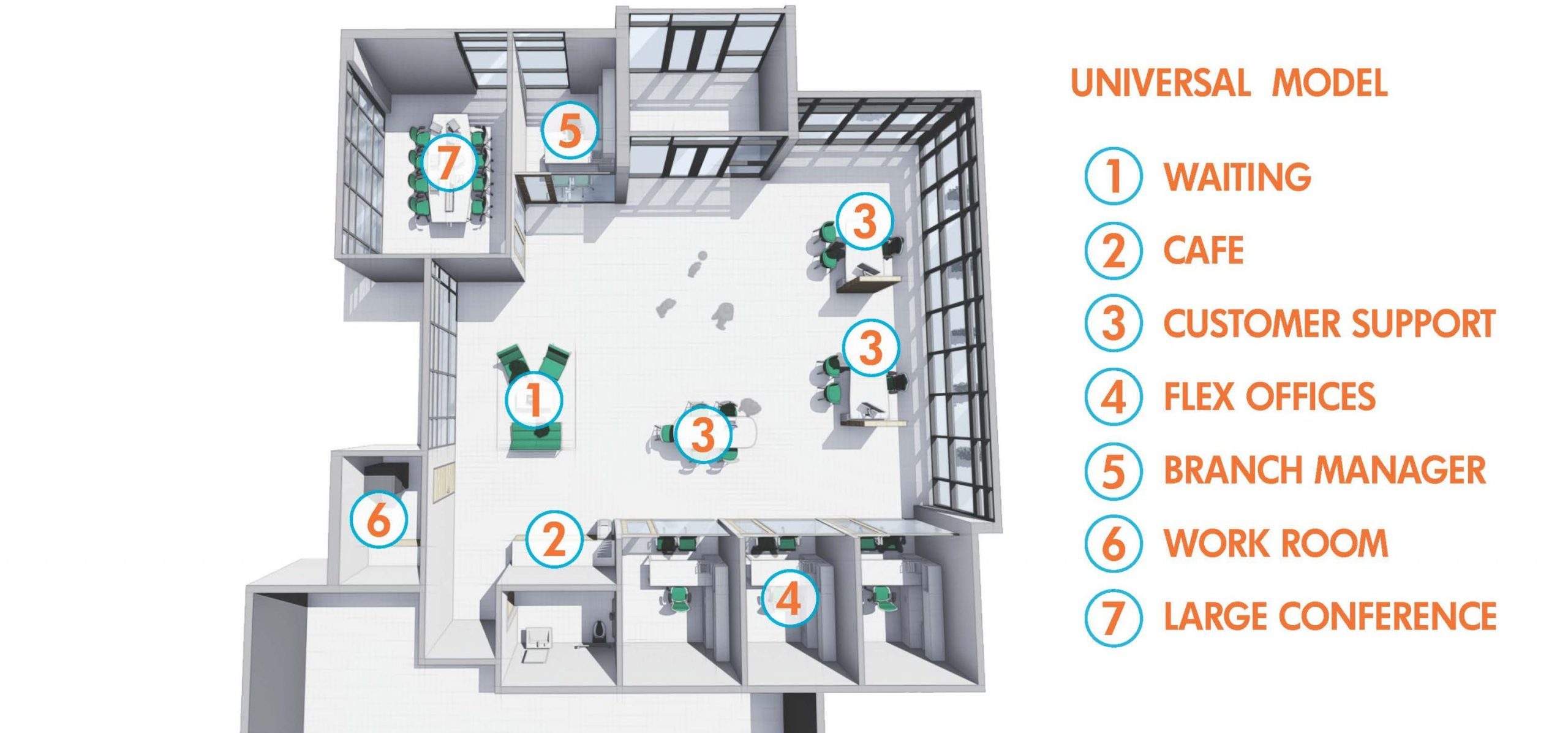

Financial Institutions (FIs) continue to face unprecedented changes in their industry, shifting from what were large, sprawling branch lobbies with multiple teller windows to some branches today who have decided to do away with tellers altogether and shift to technology instead.The decisions on how to staff and operationally function a branch today are more diverse and unique than any other time in banking. Whether it’s a renovation, a ground-up, or looking at a new prototype branch – branches today remain very personal, customer service-oriented destinations that are an extension of your institution, brand, and communities. |

|